Volatility has always been a second nature to Bitcoin. The trading highs and lows are pretty unpredictable. Another potential danger is BTC’s vulnerability. The fact that it’s a decentralized currency, and isn’t protected by any financial/law enforcement institution, makes it a sitting duck for online miscreants.

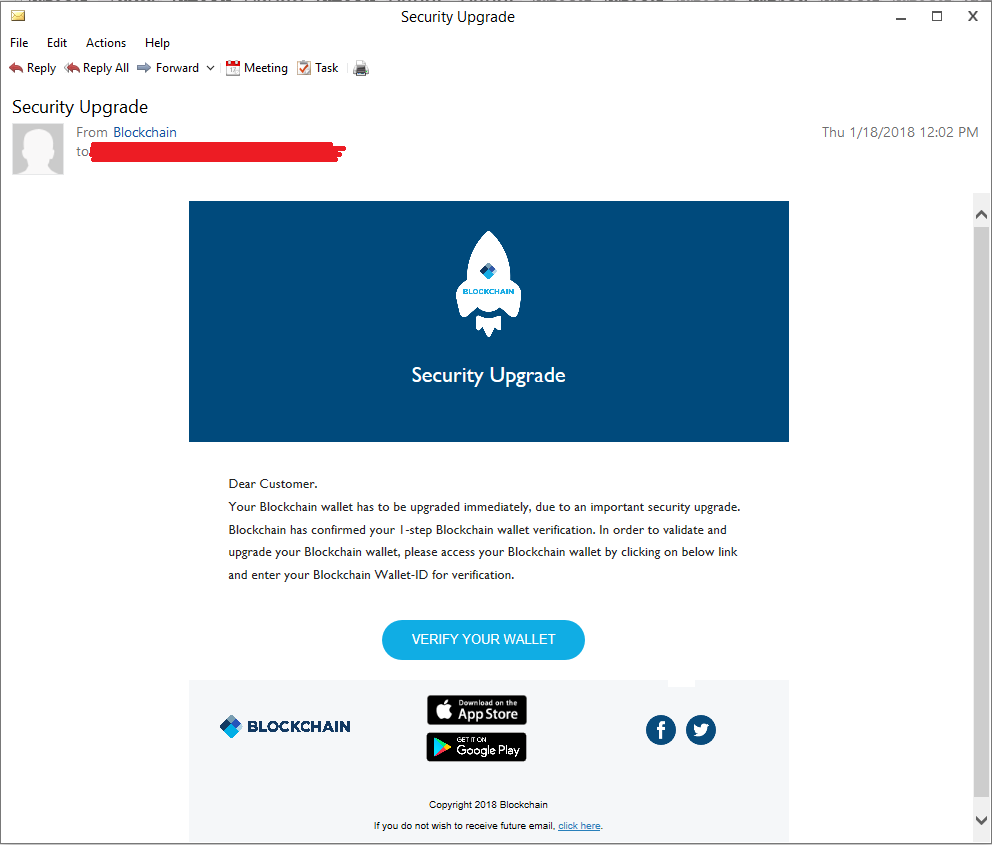

There has been a surge of phishing attacks on Bitcoin exchanges and private wallets lately, swindling traders out of millions.

Last December, NiceHash was hacked, costing investors a loss of over $60 million in a flick.

Long story short, Bitcoin is a fickle business. And, nobody should take the liberty of being careless. If you’re a BTC investor, you should definitely know how to keep your ‘new’ money safe and secure.

And in this post, we’ve discussed ways to protect BTC against thefts & hacks. Let’s read it.

Table of Contents

First Method: Add More Security To Your Devices

Cyber criminals are always on the lookout to steal passwords & wallet private keys, and make a mockery of the security claims.At the World Economic Forum in Davos, Theresa May raised concerns over the criminals, exploiting digital currencies. Speaking to Bloomberg, she said – “It’s something that has been increasingly developing. I think it’s something that we do need to look at.”

Start with your devices first. Install an antivirus app or software for your Windows PC, Mac or Android smartphone to keep it protected from unauthorized access. Also, use A-grade encryption for your PC’s hard drive and mobile phone, and get your emails screened today.

Setting up a two-factor authentication for your various online accounts can help you a long way to prevent your crypto-related information from falling into deceitful hands.

Two-factor authentication, or 2FA, adds a double layer of protection to your sensitive information. Not only does it utilize a combination of letters & alphabets to protect your identity, but also involves you providing an input to something, which is personal and known only to you. It’s a great way to keep theft and hack attempts at bay.

Second Method: Keep Your Private Keys a ‘Deep Secret’

A private key is a 256-bit number that locks a cryptocurrency wallet. You need it every time when you want your BTC out for trading or doing transactions. When trading in cryptocurrencies, it’s always important to keep your private key a ‘secret’.

That said, if anyone knows your wallet’s private keys, he can transfer your bitcoins to his wallet and spend them wherever he likes. Even worse, he can permanently delete your key, or eliminate the bitcoin.

“Without the private key, as there is no central bitcoin authority by design, there is no way to claim ownership of a set of bitcoin, “ said McDonnell.

- Create a private key, which is unpredictable and hard to guess. Use stronger passwords.

- 2FA or 2-factor authentication holds water here as well. Activate it for your key.

- Keep your devices locked, and don’t rely on one password for a longer time. Keep changing your passwords.

Third Method: Keep Your Bitcoins Stacked Up in Wallets

Prefer ‘cold’ or hardware wallets to stow away your BTCs over ‘hot’ wallets, which require the internet. Hardware-based wallets have a beefier system to secure your bitcoins, and aren’t vulnerable to attacks, since they’re offline.It’s never a sane idea to store your bitcoins on an exchange, because they are meant for trading, not to store your digital assets. Keep your bitcoins safe in a wallet.

The best ‘cold’ wallets to store bitcoins are Ledger Nano S, Trezor and Paper Wallet.

Fourth Method: Avoid Accessing Your Wallets On Wireless Connections/Wi-Fi

But, they’re the most ‘unsafe’ networks to access your crypto wallet.Public wireless connections / Wi-Fi hotspots in restaurants, coffee shops, libraries or parks might give you the benefit of internet surfing on the move.

It happened in Austria, when a user logged in to a public hotspot to check BTC price and access the wallet, but lost $117,000 worth of BTC in a blink of an eye. It was a jaw-dropping loss.

The lesson learned is – avoid using public wi-fi connections to access your wallet, or trade on an exchange.

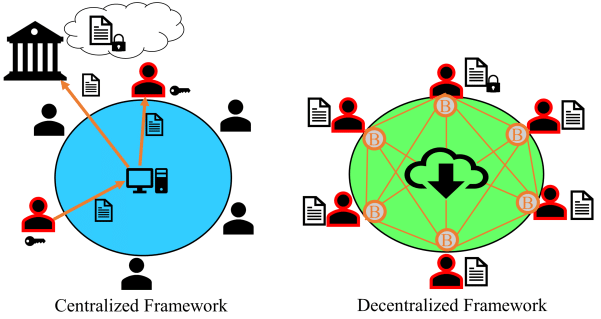

Fifth Method: Know the Difference B/W Centralized Vs Decentralized Exchanges

Before selecting an exchange, it’s important to go through its nature, history and business reputation. Decentralized exchanges might not be convenient and flexible for use, but they are definitely a better option to trade your BTCs in.The major point of difference between centralized and decentralized exchanges is that the former holds private keys while the latter doesn’t. That being so, if a centralized exchange is hacked, your private key will get stolen and you’ll lose your precious BTCs in a space of a few minutes.

Bonus Method: Use a Crypto Fund

There are many crypto funds in the market. So, choose the one that complements your needs. Tokenized funds with a certain investment strategy are considered the best. Using a crypto fund is also a method to secure your Bitcoins. They are less complex and very streamlined to offer you ease of use, especially when you’re a newcomer.

That’s a wrap, readers! For more information on cryptocurrencies and digital assets, keep coming back to this space. If you’ve a feedback, share it with us in the comments section below.